my first million

Hola! Welcome to my blog!

Let me tell you something about myself: I AM NO WAY NEAR MY GOAL. In fact, I haven’t even reached 5% accomplishment. You might be thinking that it’s too ambitious for me to aim for my first million. But you know how I see it? It’s the other way around – aiming for a million isn’t being ambitious at all. Don’t get me wrong, I’m not all crazy over money. I’m setting all these ambitions because there’s one thing I want the most – early retirement. That’s my motivation for my first million goal.

I’m only 23 years old, single with no kids, yet I’ve had my fair share of financial troubles. I started working when I was 21 years old and had my very first credit card. In the beginning, it was fine. Later on, I had another credit card with a MUCH HIGHER credit limit. You know where my story goes, right? Let’s leave it to history. Both cards were maxed out yet I kept spending my money on my wants and didn’t bother paying off my credit card dues. I ended up paying just the minimum amount every pay day. I was always broke, always living from pay day to pay day. Until finally, something hit me. Do I really want to ruin my life? Do I want my debts to be the reason why I go to work every day? Clearly, I don’t. So now I’m here, cringing at every word I type down, determined to change my spending habits. I’m so close to punching myself right now for all the bad decisions I made.

Ever since I woke up from my lavish old self, I’ve been doing a lot of reading. Tips on how to save money, and basically every reading I can find on the web about financial management. There are two basic principles: 1. SAVE and 2. INVEST.

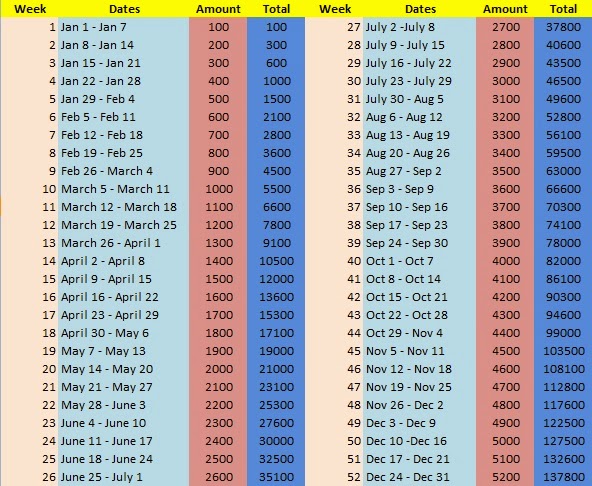

With every article, I grew even more determined to save money, pay off my debts, and invest money on stocks and mutual funds (more on that later). I came across the 52-week money challenge – a savings scheme which involves saving a certain amount per week (that’s 52 weeks in a year) in fixed increments. Below is an example.

The above is an example of 52-week challenge in P100 weekly increment. P100 for the first week, P200 for the second week, and so on. At the end of the year, if successfully accomplished, your total savings will be P137,800. I chose the P100 increment, but there are more options available. This scheme will only yield a mere 10% of my 1-million goal, but not bad at all.

Also, I signed up with Bro. Bo’s TRULY RICH CLUB, where you can learn how to grow your money and A LOT MORE. With just P5,000, you can start investing in the stock market (or mutual funds) and be in your way to financial freedom. I must say that my membership with Truly Rich Club was the best decision I’ve made. I now have an investment account in COLFinancial where I was able to invest in stocks, and a recent addition to my portfolio – mutual funds (I’m no expert at all, I only learned all these because of Truly Rich Club).

I’m so excited to share to my readers my financial journey, and I wish to inspire people of all ages to not only save, but to invest. This is my true story, no advertisements, no sponsorship.

More on my next blog! Thanks for reading! Together, let’s aim for our first million!